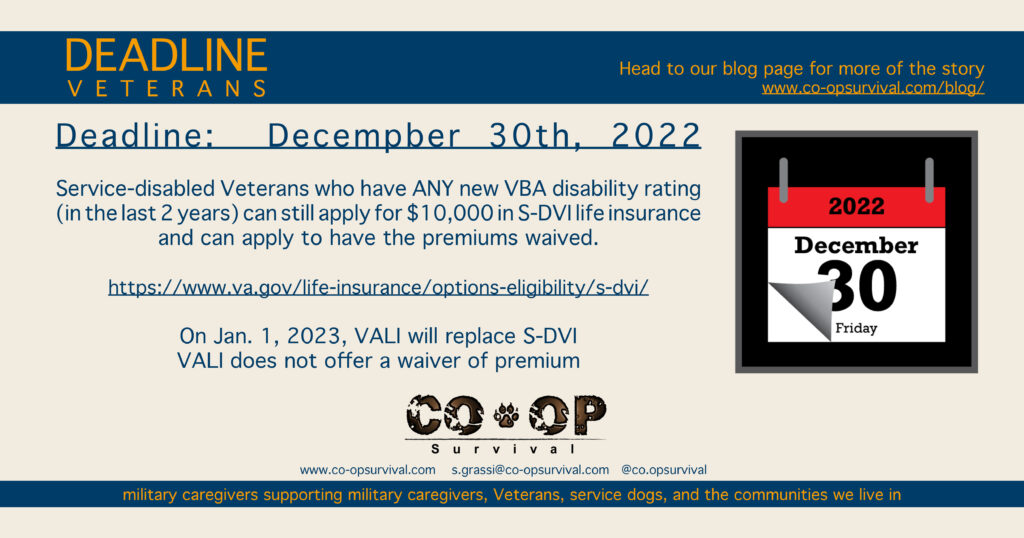

Deadline: December 30, 2022

Service-connected Disabled Veterans who were awarded a NEW Veterans Benefits Administration (VBA) disability rating within the last two years can apply for Service-Disabled Veterans Insurance (S-DVI), until December 30th of 2022.

Why should Veterans care about life insurance deadlines?

Disabled service-members qualify for great, inexpensive life insurance when they exit the military, but most don’t know about it or don’t understand how difficult it will be to get life insurance when the deadline to register for post-military life insurance has passed. One option for a small policy is S-DVI, which provides $10,000 to $30,000 in life insurance to disabled Veterans, and has premium waiver for 100% disabled Veterans, but it is being replaced with VA life insurance on January 1st, 2023. VA life insurance is guaranteed acceptance for disabled Veterans, but there is no waiver of premiums offered.

If you apply for and are approved for S-DVI, you can keep it, even after VA life insurance is active. If you miss the deadline, your only option is VA life insurance.

Why is life insurance important for disabled Veterans and their families?

In a recent study performed by the Oklahoma City VA Health Care System, researchers found that the lifespan of a service-connected, 100%-disabled female Veteran is 22% less than her non-veteran counterpart, and the lifespan of a service-connected, 100%-disabled male Veteran is 11% less than his non-veteran counterpart. The widow or widower of these Veterans might qualify to receive a portion of the Veteran’s disability pay through VA Dependency and Indemnity Compensation (VA DIC) or a few other programs, but each program has a stringent set of rules and only provides a portion of the Veteran’s disability pay. With no life insurance, the likelihood of a disabled Veteran leaving their family financially destitute is high. $30,000 isn’t going to help much, but it’s better than nothing.

Why don’t disabled Veterans have access to good life insurance?

I can’t say for sure, but from this mom’s perspective, I’d say that missing deadlines for the really good life insurance is related to how a Veteran transitions from the military and whether they have visible or invisible wounds.

Take, for example, a combat Veteran who doesn’t look injured, we’ll call her Stacy. Stacy deployed to a few combat zones, she saw things that would make many of us melt into a puddle, she felt the blast of an explosion on multiple occasions, and she landed a little too hard while exiting a helicopter. Stacy looks fine. She finished her four years of service and discharged. Stacy is twenty-five, single, and doesn’t look injured.

Stacy wasn’t given a traumatic brain injury (TBI) evaluation, her post-traumatic stress disorder (PTSD) evaluation consisted of a few questions when she returned from deployment, and her back pain was treated with a few visits to the chiropractor. On her exit-medical exam, the examiner told her to head to the VA in her hometown to deal with her headaches, back pain, and anxiety.

Stanley is a Veteran who lost his left leg in combat. It is obvious that Stanley was injured. He was sent to a wounded warrior program, where he recovered from his injury. After recovery, he was guided through the convoluted process of acquiring benefits that will support him outside of military life. Stanley is twenty-five, single, and was well advised about his life insurance options before he was handed his DD-214.

Why didn’t Stacy take care of herself?

Stacy knows what an injury looks like because she saw plenty of them in combat. In her opinion, combat injuries look bloody and often include missing body parts. She knew that she needed to head to her local VA when she got home, but finding an apartment and looking for a job came first.

Six months later, she applies for benefits, gets through her exams for compensation and pension (C&P), and a year later she is awarded a service-disability rating for TBI, PTSD, degenerative-disc disorder, sleep apnea, and a few other random issues. Her friends say, “Girl, you look fine!”, and they are right, her wounds are invisible, but Stacy is 100% disabled and will never get an inexpensive life insurance policy to protect her family.

How could they not know?

I’ve spent the last 8 years filing paperwork and juggling medical documentation for my son who is 100% disabled. In all of those 8 years, not one person or organization ever said, “Hey, he’ll never be able to get civilian life insurance, but if he adds a new disability to his rating, he can apply for S-DVI and request a waiver of fees”. Nope, not one of them ever said that.

So, why are we sharing this information now?

Caregivers support other caregivers and the Veterans we care for. A few months ago, quite a few military caregivers were asking if anyone had heard about the new VA life insurance program.

I hadn’t, but I was excited to think that my son might be able to qualify. I looked into it, and… huh, there it was, a deadline for a program I’d never heard of. Funny how that works.